On November 30, 2024, US President-elect Donald Trump shocked the world with a daring declaration. Governments, currency experts, and international markets all took notice when Trump threatened to impose 100% tariffs on the nine-nation BRICS bloc if they persisted in undermining the dollar.

Trump threatened to impose 100 percent tariffs on these nations unless they pledged not to support any other currency in place of the powerful US dollar or develop a new BRICS currency.

The idea that the US dollar is seriously in danger of being replaced has been rejected by a large number of analysts and currency specialists. However, there is now apprehension over the future of dollar dominance due to mounting concerns from the BRICS’ expanding strengths and changes in the US economy.

Despite the US president’s warning, most currency analysts and professionals in Pakistan reject the idea that the dollar is in immediate danger.

The CEO of renowned financial company Tresmark Investment, Faisal Mamsa, stated: “I have read a number of study studies and have not discovered any reliable proof of a significant danger to the dollar. The introduction of a different currency by BRICS to challenge or replace the US dollar’s supremacy is not realistically possible.

Although some analysts recognize that things could change, they stress that neither the US administration nor the State Bank of Pakistan are making any real attempts to address the ramifications of Donald Trump’s threat at this time.

Trade conundrum

Pakistan may be affected by these geopolitical changes even though it is not a part of the BRICS alliance. With about 20% of Pakistan’s total exports, the US continues to be the country’s top export partner. Pakistan exported $5.9 billion to the United States in fiscal year 2024, which was a substantial amount given that the nation’s total exports were $30.6 billion.

According to a top banker, “Pakistan may face double threats: the fluctuating dollar value and the US trade policy aimed at reducing trade deficits.”

He continued by saying that because the US imported only $1.87 billion from Pakistan in FY24, the country is also a trade deficit indicator for the US.

The majority of currency specialists do not anticipate the US dollar’s impending destruction, notwithstanding the worries expressed by certain financial analysts and political figures.

International trade and monetary systems specialist S.S. Iqbal thinks the problem is more complicated than it seems. He claimed that because the US has taken a more defensive stance, “the dynamics of world trade are undergoing a vital change.”

“In other words, instead of projecting its economic dominance globally as it has in the past, the US is concentrating on safeguarding its own interests.”

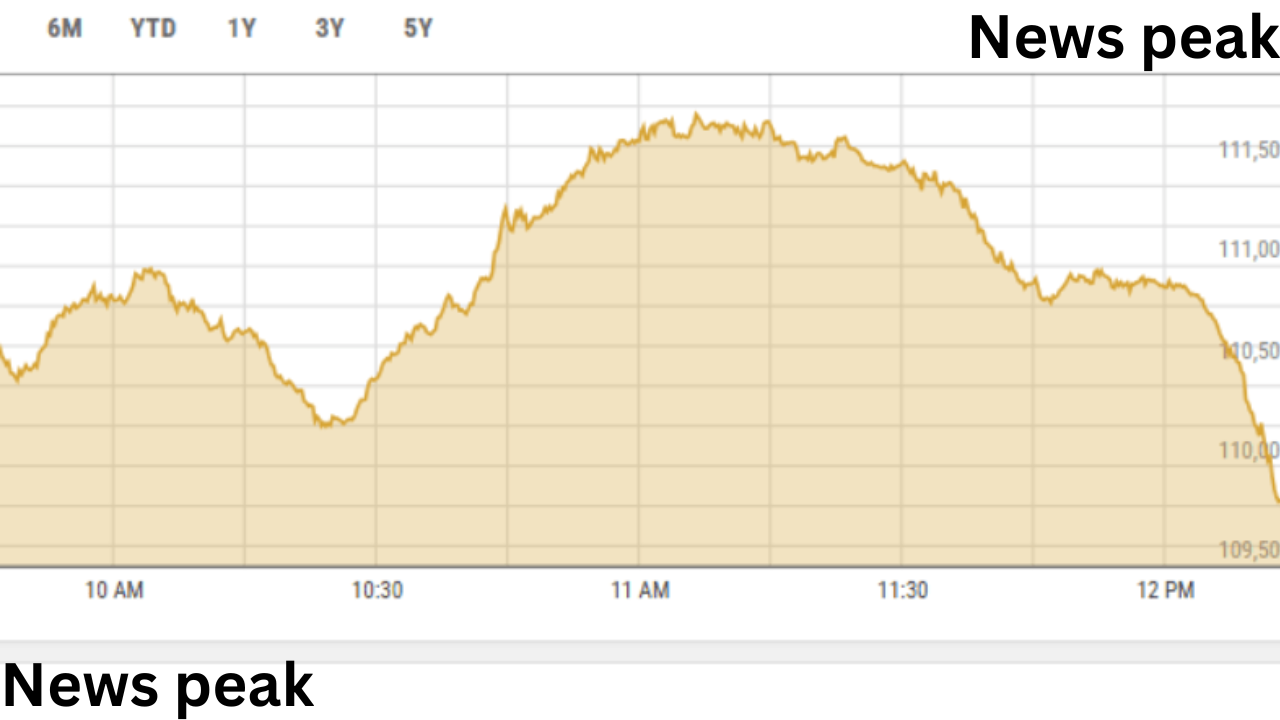

Pakistan has been comparatively safe thus far. The rupee’s value in relation to the US dollar has remained steady throughout 2024, however some experts are worried that the State Bank may have intervened with government support to achieve this stability.

January 2024 witnessed both the highest and lowest dollar rates, according to banking market data. By January 29, the US dollar had dropped significantly from its January 4 price of Rs281.70 to Rs275.86.

Since then, the dollar has steadily increased in value relative to the rupee, reaching an average of Rs278.33 at the end of the year.

On the other hand, 2023 was a year of tremendous ups and downs. Economic instability was exacerbated when the dollar reached as high as Rs306 in the interbank market and Rs340 in the open market. Business confidence was shaken by the rupee’s sharp decline in 2023, which accelerated the economy’s dollarization.

The issue was made worse in 2023 by the thriving foreign exchange parallel market. With a premium of Rs30–35 per dollar, remitters found it easier and easier to send money using the illicit Hundi and Hawala methods.

“2024 will be remembered for the stability of the exchange rate, which allowed both exporters and importers to navigate the uncertainty,” stated Zafar Paracha, general secretary of the Exchange Companies Association of Pakistan.He pointed out that the local currency had advanced significantly, allowing the SBP and the government to profit from the circumstance.

Throughout 2024, the central bank became a significant buyer of dollars from the banking sector, guaranteeing sufficient liquidity.