Meezan Bank denied a “data breach” on Thursday, following social media allegations of numerous customers experiencing unauthorized debit and credit card transactions.

Many social media users reported illegal bank account activities over the last week. They reported that substantial sums of money were transferred from their debit cards without their knowledge. Some stated that an apparent data leak had happened.

According to a client advisory released today, “the rumours regarding a data breach at Meezan Bank are entirely false.”

It assured people that their data was “completely safe with us” and that there had been “no hacking whatsoever.”

The bank also stated that it was taking all required steps to ensure that affected customers received compensation as soon as possible.

“All of the disputed transactions submitted to the bank recently were unsecured e-commerce purchases. These transactions are covered by International Payment Schemes’ chargeback process, and the impacted customers have been completely repaid.

It also warned clients to exercise caution when using cards online.

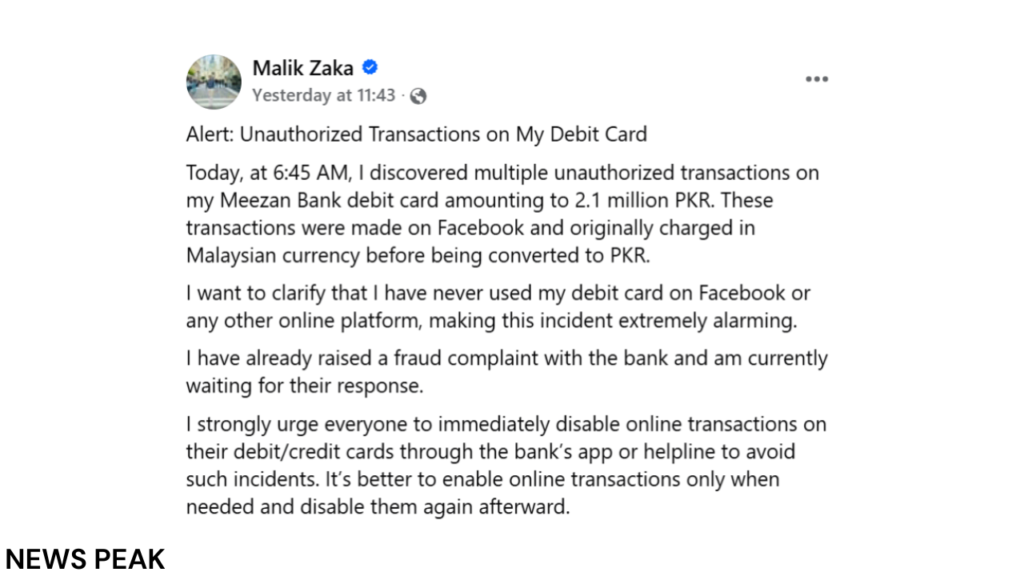

Malik Zaka, an Islamabad resident, reported an event on the Facebook page “Voice of Customer” a day ago, alleging that many unauthorised transactions occurred on his Meezan Bank debit card amounting to Rs2.1 million, labeling the occurrence.

Zaka told NewsPeak that seven transactions were performed on Facebook in Malaysian money and subsequently changed to PKR.

“These were cards that I had never used for internet banking,” he explained, adding that he reported the event to the bank, which then blocked the cards due to fraudulent behavior.

He also stated that the cash was refunded within three hours, but he considered the occurrence “suspicious,” alleging it could be a “data breach” because numerous people reported the same incidence.

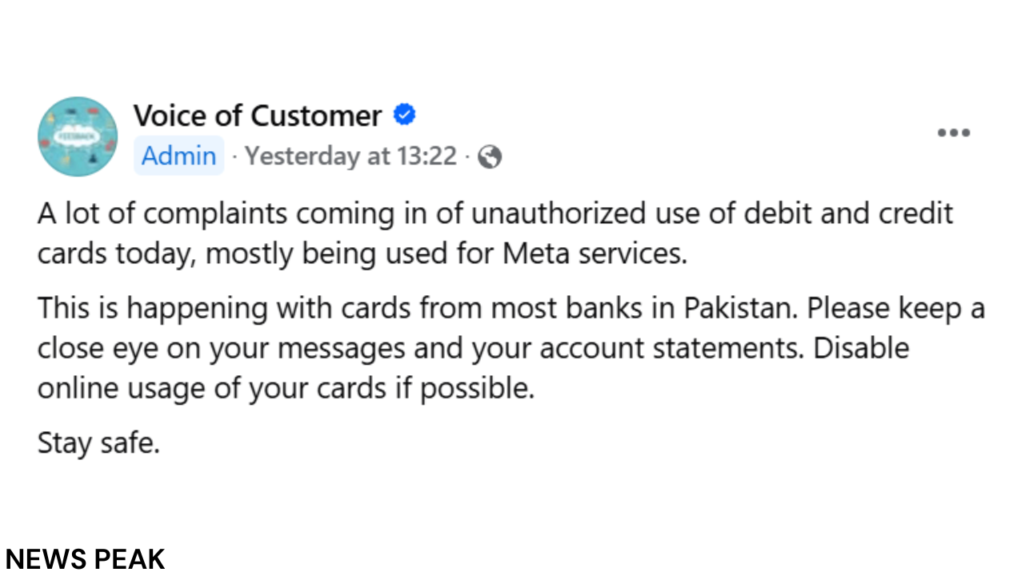

According to a post by the Facebook group’s administrator, there have been numerous complaints about unauthorised card usage.

Another client from Lahore, who requested anonymity, informed Dawn.com that transactions of Rs1.4 million were made using his card, and that the sum was eventually reimbursed.

“The transaction occurred, but I was never notified because I did not receive a one-time password or message.

He further stated, “If card was used from my account, not one invoice was generated.”