The Indian rupee fell to a record low on Tuesday, but government bond prices soared, as the appointment of career bureaucrat Sanjay Malhotra as the next Reserve Bank of India (RBI) governor fuelled expectations of rate reduction.

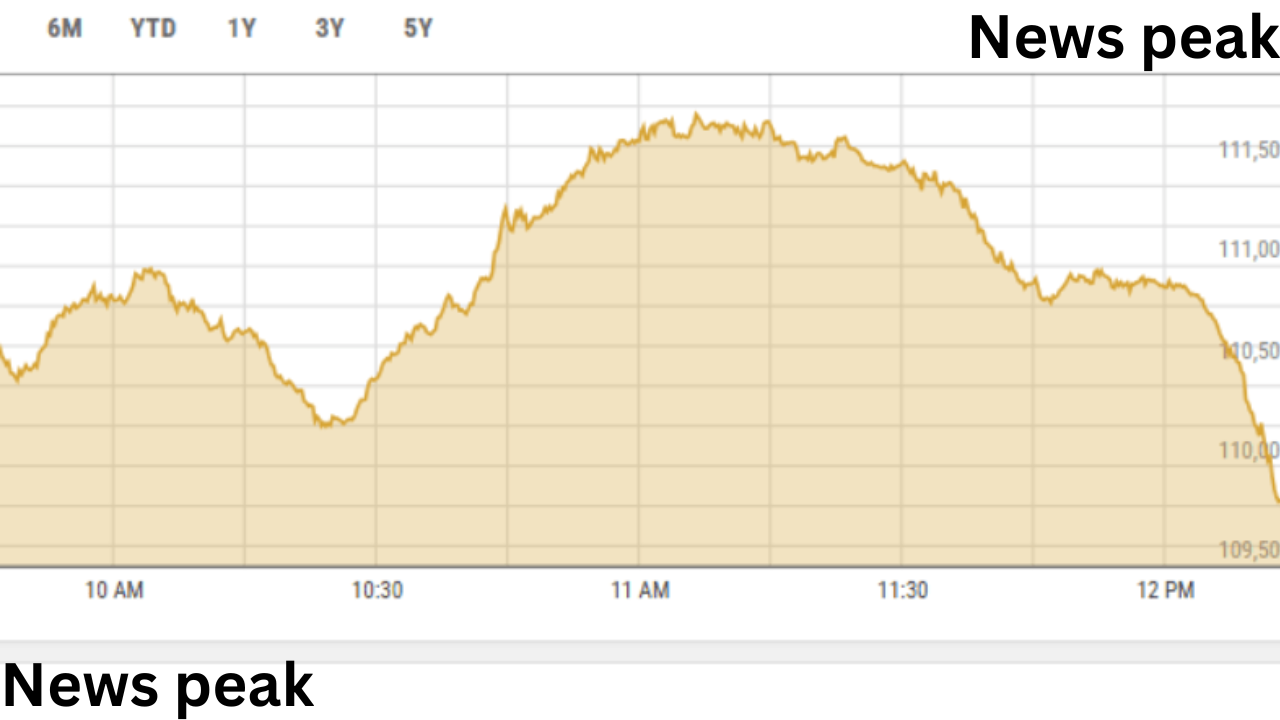

The rupee sank to 84.8550 against the US dollar, beating its previous all-time low of 84.7575 set last week, while the 10-year bond yield slipped 2 basis points to 6.6954 percent. Yields are inversely related to bond prices.

India’s five-year overnight index swap, which measures interest rate expectations, fell to a three-month low of 5.97 percent.

The RBI is expected to intervene to support the rupee, according to traders.

Malhotra, who is now the finance ministry’s revenue secretary, has been appointed as RBI governor for a three-year tenure beginning December 11, as outgoing governor Shaktikanta Das’s six-year term ends on Tuesday.

Malhotra’s three-decade career has included positions in financial services, power, taxation, and information technology.

Patra’s term ends in mid-January, and the administration is seeking a replacement.

Three new external members of India’s rate-setting panel were appointed in October after the mandates of the former members expired.

“With Malhotra’s appointment, there is an expectation that there will be a tilt towards supporting growth,” said Anshul Chandak, RBL Bank’s head of treasury.

“A February rate cut by the RBI seems more certain now.” On December 6, the RBI maintained its benchmark interest rate while lowering the cash reserves that banks must retain, essentially easing monetary conditions.

“If the RBI adopts a growth-focused monetary policy, as suggested by recent dovish expectations, narrowing interest rate differentials could weaken carry trade inflows and hurt the rupee,” a bank trader told Reuters.