Remittances have greatly increased as a result of Pakistan crackdown on the illicit foreign exchange trade, Bloomberg said on Tuesday.

According to the article, which cited figures from the State Bank of Pakistan (SBP), remittances increased by 34% to $14.8 billion in the five months ending in November compared to the same period last year.

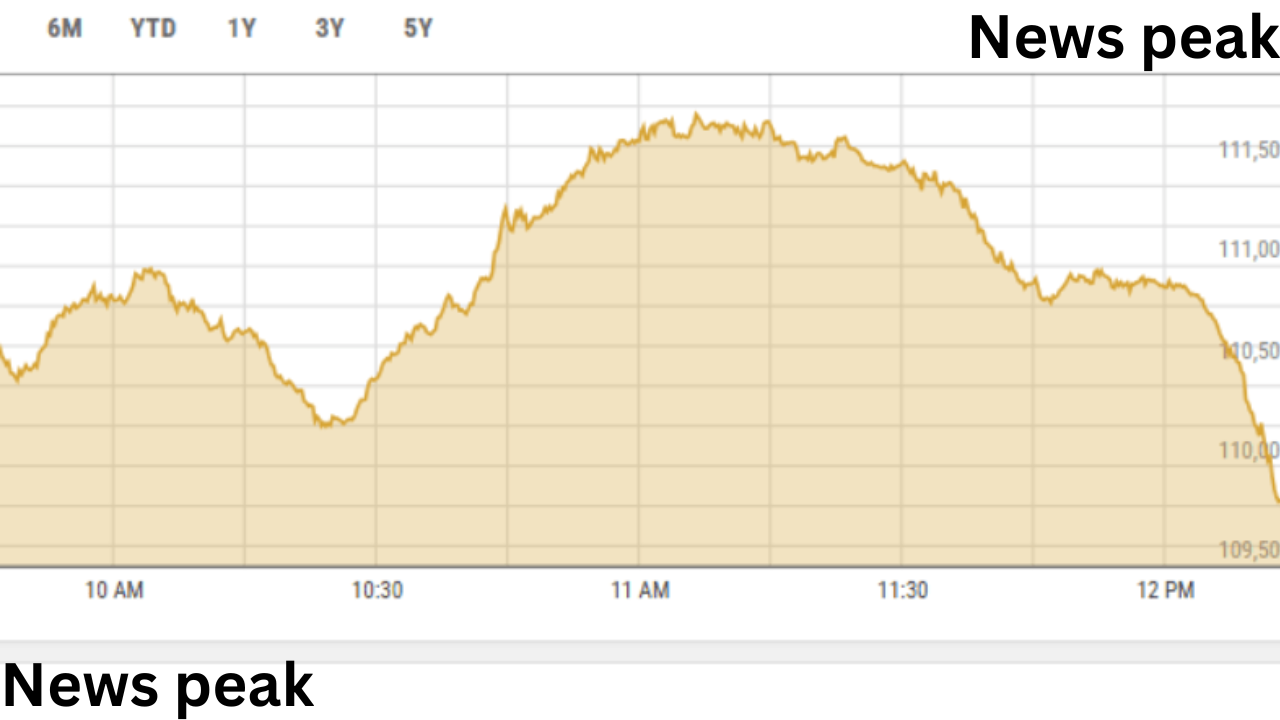

It also mentioned that the rupee has increased by 2 percent this year and is regarded as “among the best-performing emerging-market currencies,” driven by remittances and the International Monetary Fund’s (IMF) lending program.

Muhammad Aurangzeb, the finance minister, had previously discussed raising remittances in a positive manner. He had stated that for the current fiscal year, the nation anticipated remittance inflows of roughly $35 billion.

Remittances to Pakistan totaled $11.85 billion between July and October, or $2.962 billion on average per month. There was an increase in remittances, as the country received $2.859 billion in September and $3.052 billion in October.

The country received $30.25 billion in FY24, a 13.3 percent drop from FY15.

According to financial analysts, the increased remittances are the consequence of stable exchange rates and a campaign against illicit currency trading.

The report also noted that the nation has been following the IMF’s advice and enacting strict economic policies.

Bloomberg stated that it “may have helped move some of the transactions to the official banking channels by cracking down on the unofficial dollar trading,” which “contributed to foreign-exchange reserves rising to over $12 billion by end-November, the highest since March 2022.”

According to Zafar Paracha, general secretary of the Exchange Companies Association of Pakistan, the illicit dollar market has shrunk by at least 20 percent in the last two years, with up to $10 billion of that money moving into legitimate banking channels.

For global and Pakistani perspectives on tech, business, and finance, follow Dawn Business on Facebook, Instagram, LinkedIn, and Twitter.